Feature Spotlight

New Feature

Feature Announcement: Family Tax Information For Parents And Organizations

One desirable aspect of after-school child care and sports programs is that the fees are often tax deductible. However, gathering all of the necessary information come tax time can be a hassle for parents and organizations alike. Program directors are flooded with calls at the beginning of the year from parents that need tax ID numbers, receipts, and amounts paid for each child so that they can claim the Child and Dependent Care Credit (CDCC) on their tax returns.

To make tax time easier for everyone, we are excited to announce a new feature that allows parents to retrieve the program’s tax information right from the registration system!

The Child And Dependent Care Credit: Who Is Eligible?

According to the IRS website, parents who meet the following criteria may be eligible to claim the CDCC:

- They paid a person or organization to care for their children

- The child was under age 13 at the time the care was provided

- The child lived with them for more than half of the tax year

If the family qualifies for the tax credit, they may be able to claim up to $3,000 of expenses for one child or $6,000 for two or more children, for a credit of up to 35% of that amount.

In order to claim the CDCC, parents must provide the following information to the IRS:

- The provider’s tax identification number (unless the organization is tax-exempt)

- The provider’s mailing address

- The exact amount that was paid per child for child care

For busy families, it can be difficult to keep track of all of this information, which is why many parents turn to their child care providers for help.

Retrieving Tax Information From CourseStorm

When families enroll their children in child care programs that use CourseStorm, all of the required tax information will be available to them right there in the system. The information is even broken down per child, so parents will be able to see at a glance which child was enrolled in which program, the exact amount they paid, and the organization’s tax identification number.

Retrieving the information is easy for parents. They simply login to their account from the course catalog on your website, and tax information will be available at the beginning of the year.

How To Tell Parents About The New Feature

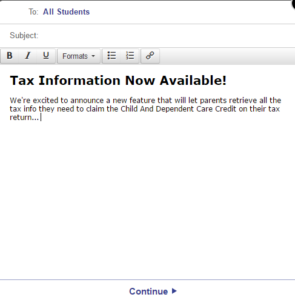

Because this is a new feature, you’ll want to make parents aware of it toward the end of the year – before the calls start coming in for tax information! While you may choose to do a printed memo that goes home with all children, we recommend taking advantage of the built-in email feature in CourseStorm to send a message to parents of children enrolled in tax-deductible classes.

Simply go into each class, click “Roster,” then click the “Send Email” button. In your message, explain the new feature and the benefit to parents, and give them the steps for logging in and retrieving the tax information at the beginning of the year. For organizations that offer kids’ classes exclusively, you can use the “Emails” function under the “Marketing” section to send a message to “All Students” in one easy place.

We hope this information has been helpful and you’re eager to share the benefits with your staff and parents!

With our easy-to-use new feature, parents can enroll multiple children in multiple classes and never have to worry about filing paper receipts to include with their tax returns later. Start your free trial now or get in touch with us at sales@coursestorm.com to learn more about the new tax information feature.

Brian Rahill

Brian is a scientist-turned-education technology executive. He has founded and led technology companies for more than 20 years and uses his analytical mind and experimental approach to spur growth in small and medium businesses and start-ups. He is passionate about using technology to enhance access to lifelong learning.